Deciding whether to rent or buy a home is a big decision, especially in Florida’s fast-paced real estate market. Florida real estate is known for its dynamic trends, making it essential to weigh the pros and cons of each option. Whether you’re a first-time homebuyer, an investor seeking the best opportunities, or a real estate professional advising clients, understanding the market’s nuances is crucial. In 2024, factors like shifting interest rates, fluctuating home prices, and evolving trends in Florida real estate could significantly influence your decision.

In this guide, we’ll look at the main differences between renting and buying in Florida, compare the costs, and give helpful tips for different types of buyers.

Table of Contents

ToggleRenting in Florida: Pros and Cons

Renting remains a popular option for many, especially in Florida’s fast-paced housing market. Below are some key pros and cons:

Pros of Renting:

-

- Lower Initial Costs: Renting requires less upfront investment compared to buying, with no down payment and lower closing costs.

-

- Flexibility: Renting allows you to move more easily. If you’re not ready to commit to a specific area or want to explore Florida’s diverse cities, renting gives you the freedom to relocate.

-

- Maintenance-Free Living: Renters generally don’t need to worry about repairs or maintenance costs, as these are usually the landlord’s responsibility.

-

- Market Uncertainty: Renting can be a good option in an uncertain market, where home prices or interest rates are high.

Cons of Renting:

-

- No Equity Building: Rent payments don’t contribute to building equity. You’re essentially paying for the privilege of living in the space without ownership.

-

- Rent Increases: Rent prices can fluctuate, especially in high-demand areas. Florida’s rental market has seen significant price hikes, leaving renters with the possibility of higher rents upon lease renewal.

-

- Limited Control: Renters have less control over property customization and are subject to landlord decisions, such as rules about pets, renovations, or lease terms.

Buying in Florida: Is It Worth It in 2024?

Florida’s real estate market offers potential opportunities for buyers, but there are factors to weigh carefully before taking the plunge.

Pros of Buying:

-

- Equity Growth: Every mortgage payment you make helps build equity, which can be a valuable long-term investment.

-

- Stability: Owning a home provides stability with fixed mortgage payments (if you have a fixed-rate mortgage) and the potential for long-term appreciation in property value.

-

- Personalization: Homeowners have the freedom to remodel and make changes to their property to suit their needs and preferences.

-

- Tax Benefits: Homeowners can take advantage of tax deductions, such as mortgage interest and property taxes, which can offset some of the costs of ownership.

Cons of Buying:

-

- Higher Upfront Costs: Buying a home requires a substantial upfront investment, including the down payment, closing costs, and other fees.

-

- Ongoing Expenses: Homeownership comes with recurring costs like property taxes, homeowners insurance, maintenance, and repairs.

-

- Market Volatility: Florida’s housing market can be unpredictable. While real estate typically appreciates over time, there can be short-term market dips that affect your investment.

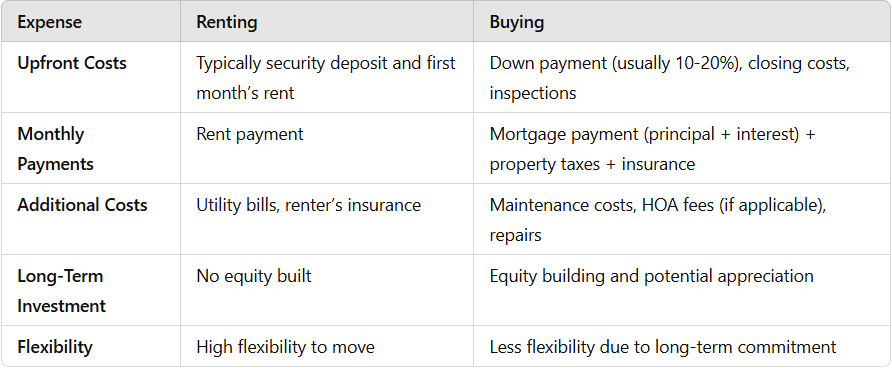

Financial Considerations: Comparing Costs of Renting vs. Buying

Let’s take a closer look at the costs of renting vs. buying in Florida with an easy-to-understand comparison:

Example:

-

- A rental in Miami might cost around $2,500 per month. Over a year, that totals $30,000 with no return on investment.

- On the other hand, if you buy a home for $350,000, your monthly mortgage might be around $2,000 (assuming a 30-year loan at 6% interest). After a year, you’ve built equity, and your property may have appreciated in value.

Factors to Consider Before Making Your Decision

Choosing between renting and buying depends on several personal and market factors. Here are some key considerations:

-

- Location: Florida’s housing market varies greatly by location. In cities like Miami, Orlando, and Tampa, home prices and rents can be higher, which may influence your decision.

- Market Trends: Research local market trends. In 2024, interest rates may influence mortgage affordability, and home price growth could slow down in certain areas.

- Long-Term Plans: If you plan to stay in Florida for several years, buying could be a smarter investment. However, if you’re unsure about your long-term plans, renting offers flexibility.

- Financial Stability: Consider your savings, debt, and income stability. Renting typically requires less financial commitment, while buying requires a larger investment and the ability to handle unforeseen home maintenance costs.

Strategies for First-Time Homebuyers, Investors, and Real Estate Professionals

-

- First-Time Homebuyers: Consider starting with a smaller property or exploring first-time homebuyer programs, such as down payment assistance and lower interest rates, to make the transition smoother.

- Investors: Florida remains an attractive market for real estate investors due to its population growth, tourism, and rising rental demands. However, it’s essential to analyze rental yields and property appreciation in specific regions before committing to an investment.

- Real Estate Professionals: For agents advising clients, offering personalized insights based on the client’s financial situation and long-term goals can be invaluable. Providing them with current market data and predictive trends will help them make well-informed decisions.

Bottom Line

The decision to rent or buy a home in Florida depends on your unique circumstances, including financial goals, lifestyle preferences, and long-term plans. By understanding the pros and cons of each option, evaluating your financial situation, and staying informed about market trends, you can make the best decision for your future.